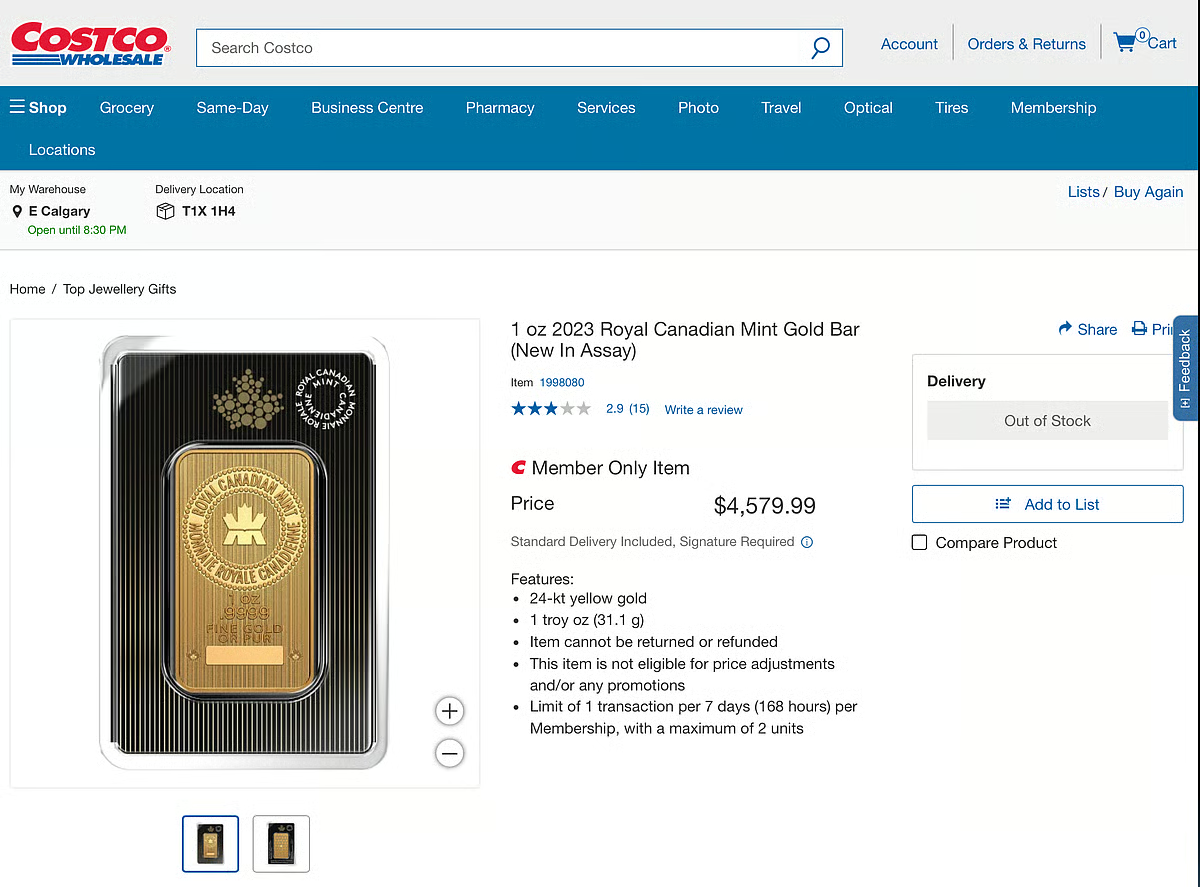

There’s something quietly surreal about browsing for maple syrup and stumbling across a gold bar. Yet that’s exactly what’s happening at Costco, where demand for precious metals has exploded over the last two years, so much so that the retailer has now placed fresh limits on purchases. As of May 16, Costco members can only buy two one-ounce gold bars per day, and only within a single transaction.

This might sound like a logistical tweak, but it speaks volumes for the precious metals market and retail investing in general.

Why the New Limits Matter

Costco first introduced gold bullion to its online store in 2023, a move met with more curiosity than conviction. Few predicted it would ignite a retail investment trend. But just two years later, the company sold more than $100 million in gold bars, and demand kept climbing. Even as the spot price of gold approaches CAD 3,500 per ounce, buyers haven’t flinched.

That’s a significant jump from the roughly $1,810 we saw in early 2023, and it tracks with rising inflation concerns, geopolitical instability, and a general flight to hard assets. But what’s striking isn’t just the price—it’s where people are buying. Costco has become a surprisingly influential player in the bullion market.

Initially, Costco allowed up to five gold bars per customer every 24 hours. Reducing that to two and capping purchases to one transaction per day seems to reflect more than just inventory management. The adjustment is likely designed to keep the market accessible, avoid hoarding, and reinforce fair distribution, especially as product listings continue to sell out in hours.

For investors, particularly in Canada, the move underscores gold’s shifting role. It’s no longer confined to niche dealers or complex financial instruments. It’s available with your groceries. That accessibility has implications, especially for younger or first-time investors who may have been wary of buying bullion in the past.

The Rise of Retail Bullion Sales

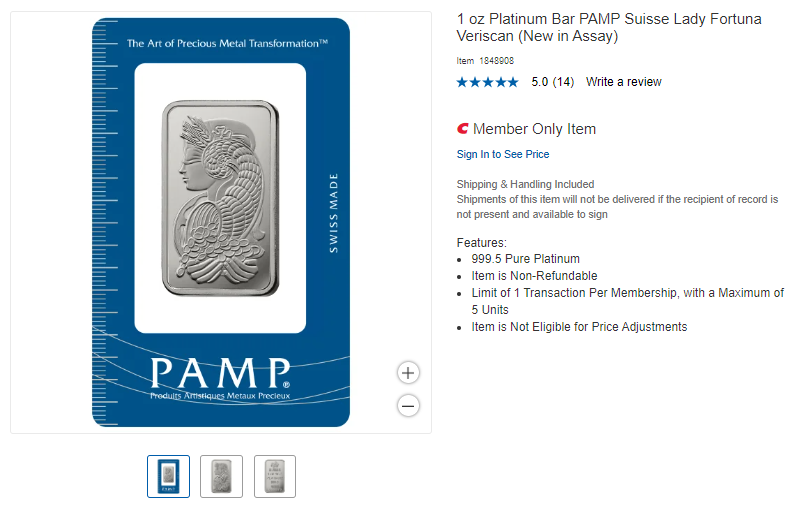

Costco’s success isn’t limited to gold. In late 2024, it introduced one-ounce platinum bars to its offering, sourced from Swiss refiner MKS PAMP. Like gold, these platinum bars are available exclusively online to members, with a five-bar-per-person cap.

The expansion into platinum suggests this isn’t a passing experiment. It’s a deliberate strategy, one that’s clearly resonating with consumers. During a September 2024 earnings call, Costco CFO Gary Millerchip confirmed that bullion sales were contributing “double-digit” growth to the company’s e-commerce revenue. It’s not every day a company credits precious metals for online sales success.

More than just a boost to the bottom line, it positions Costco as a trusted channel for acquiring physical assets—a role traditionally held by banks, bullion dealers, or online investment platforms.

Is This the Future of Precious Metals Investing?

Physical bullion has always held a certain allure. It’s tangible, universally valued, and historically resilient during economic downturns. What’s changing is how—and where—Canadians are accessing it. The ease of buying gold through a familiar retail platform removes many of the frictions that once discouraged casual investors: complex verification processes, higher premiums, or a lack of confidence in unfamiliar vendors.

But the popularity also invites questions. How should individuals store their purchases? Do the premiums justify the convenience? Is this a serious investment or a retail novelty?

Costco’s use of reputable refiners like PAMP Suisse helps address concerns around authenticity and quality. But potential buyers still need to consider storage and insurance costs, especially as their holdings grow. Unlike gold-backed ETFs, physical bullion doesn’t generate income, and it requires careful handling.

Even so, the physicality of bullion is precisely what appeals to many. In times of uncertainty, the reassurance of holding a tangible asset can outweigh the benefits of more abstract investment vehicles.

Kirkland Gold? Not Just Yet

During that same earnings call, analyst Greg Melich of Evercore ISI jokingly asked whether Kirkland Signature, Costco’s ubiquitous private label, might eventually branch into gold. The answer from CEO Ron Vachris was a firm “no plans at this time,” but the question itself reflects just how mainstream the conversation around bullion has become.

There’s also a deeper symbolism here. If Costco ever did launch a Kirkland-branded bullion product, it would signify a full-scale normalization of gold as a consumer good. It might also reshape perceptions of what constitutes a retail brand. But even without a private label, the brand trust that Costco brings is already reshaping the bullion market.

For jewellers and precious metals professionals in Canada, the growth of retail bullion signals a need to stay agile. While the mass market may not replace the premium experience of custom jewellery or specialist advice, it’s changing consumer expectations around access, pricing transparency, and convenience.

Jewellery retailers might consider whether there’s room to bridge the gap—offering bullion products alongside their traditional fare, or using their credibility to provide educational content on precious metals investing. As bullion becomes less niche, so too must the approach to selling it.

There’s also the matter of competition. Costco’s ability to negotiate favourable prices at scale is difficult to match, but its focus is limited. It doesn’t offer customization, design consultation, or expert support—the very things that independent retailers excel at. There’s an opportunity here to reassert those strengths while still catering to a more investment-minded customer base.

Final Thoughts

Costco’s gold bar limits might seem like a minor footnote in retail policy. But for investors, jewellers, and the precious metals industry at large, it’s a sign of how quickly the ground is shifting.

Gold is no longer the reserve of vaults and finance firms. It’s now a line item in the shopping cart—and in many cases, the first physical investment that new buyers ever make. The move to restrict purchases is not just a supply-chain adjustment; it’s a barometer of the metal’s growing popularity and legitimacy in the retail landscape.

Canadian investors would do well to watch this space. Whether you’re in the market for bullion or simply curious about the future of precious metals, the lesson is clear: gold is back in fashion—and this time, it comes with a Costco receipt.

![]()