In the fascinating world of bullion coinage, 2023 has been a year of dynamic change and intriguing trends. This blog post delves into a comparative analysis of the bullion coin markets in the United States and Canada, highlighting key sales figures and market movements. With a special focus on the iconic American Eagle and Canadian Maple Leaf coins, we uncover what these trends mean for collectors and investors alike.

U.S. Market Overview

The United States Mint has reported a significant increase in sales of its American Eagle 1-ounce .999 fine silver bullion coins. By October 31, 2023, sales had risen by 33% compared to the entire year of 2022, reaching an impressive 21,215,000 coins. This surge underscores a growing interest in silver as a valuable investment asset.

In contrast, the sales of American Eagle .9167 fine gold bullion coins have shown a moderate increase. The 2023 sales figures stand at 1,017,000 ounces, slightly above the 980,000 ounces sold in 2022. The detailed breakdown includes various denominations, from 1-ounce to tenth-ounce coins, each presenting a unique perspective on market preferences.

Platinum American Eagles, however, have seen a stark decline in sales. Only 12,700 coins were sold through October, a steep drop from the 80,000 coins sold in the same period in 2022.

Canadian Market Reports

The Canadian bullion market in 2023 showed some mixed results in its first quarter:

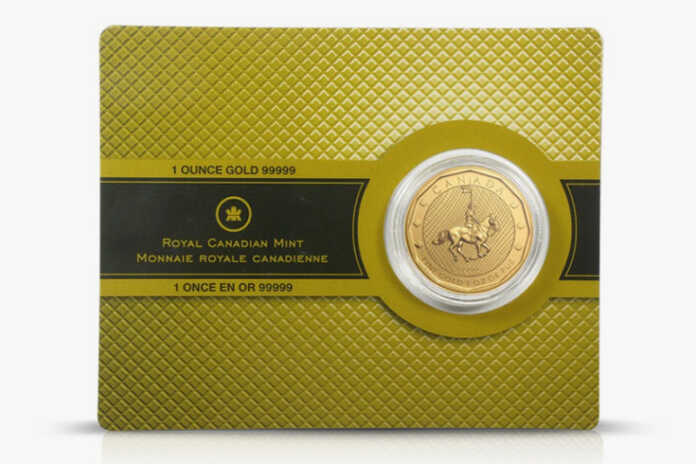

- Overall Performance: The Royal Canadian Mint reported stronger than expected financial results, buoyed by a late-quarter surge in global bullion demand.

- Revenue Trends: Consolidated revenue decreased to $769.7 million in 2023, down from $865.0 million in 2022.

- Gold Bullion: Gold volumes saw a 13% decrease, totaling 318.7 thousand ounces compared to 366.9 thousand ounces in the same quarter of 2022.

- Silver Bullion: Silver sales slightly increased by 1%, reaching 9.0 million ounces, up from 8.9 million ounces in 2022.

Comparative Analysis

The comparison of the two markets reveals a notable divergence in gold bullion sales trends, with the U.S. experiencing moderate growth while Canada saw a decrease in the first quarter of 2023. Conversely, both markets observed an increased interest in silver, albeit with Canada showing a more modest rise.

Market Insights

Experts suggest these trends may be influenced by various global economic factors, including market stability and investor sentiment towards precious metals. The distinct patterns in gold and silver sales reflect the diverse strategies and preferences of investors in each market.

As 2023 progresses, the bullion coin market continues to present a dynamic landscape for investors and collectors. The interplay between the U.S. and Canadian markets offers unique insights, highlighting the evolving nature of this sector.

Stay tuned to Canadian Jeweller for more updates and in-depth analysis of the bullion market as we continue to navigate these exciting times and visit Express gold refining