Economic Uncertainty and Political Turmoil Affecting Swiss Watch Market

Economic Uncertainty and Political Turmoil Impacting Retailer Behavior

Retailers in the United States have been cautious, reflecting broader economic uncertainty and political turbulence. As households face increasing financial pressure, discretionary spending, particularly on luxury items like Swiss watches, has tightened. This cautious approach by retailers aims to avoid overstocking amidst unpredictable consumer demand.

While the U.S. saw a slight decline, exports to China and Hong Kong registered dramatic drops. In May alone, exports to China plummeted by 18%, while Hong Kong experienced an even sharper decline of 22.7%. This downturn in the Chinese market, traditionally one of the robust segments for Swiss watches, underscores the significant impact of economic and political factors on global luxury markets.

Japan’s Rising Imports Amid a Weak Yen

Contrary to the trends in the U.S., China, and Hong Kong, Japan’s market for Swiss watches saw a positive shift. The weakness of the Japanese yen has made the country’s prices more attractive to international visitors. As a result, Japan grew its imports of Swiss watches by 5.8% in May. This increase highlights how currency fluctuations can influence luxury goods markets, attracting buyers seeking better value.

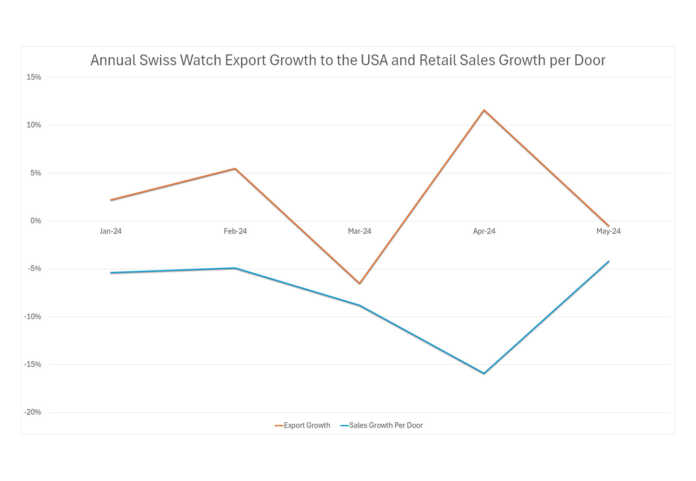

Despite the decline in May, Swiss watch exports to the United States had been on a rising trend throughout the year. This growth, seen alongside declining retail sales, suggests that retailers were backfilling inventory for high-demand models with long waiting lists. These strategies have resulted in increased stock levels across the sector.

However, data from the Luxury Watch Barometer, which collates point of sale information from thousands of retailers nationwide, indicates a year-on-year decline in same-store sales every month this year. This decline reflects the challenging retail environment and shifting consumer priorities.

Trends from the First Five Months of 2024

Across the first five months of 2024, the growth in imports of Swiss watches has outpaced the growth in retail sales. This discrepancy suggests that while demand remains robust for certain high-end models, overall consumer spending is restrained, and inventory levels are higher than normal.

The current trends in Swiss watch exports highlight the intricate balance between supply and demand in the luxury watch market. Economic uncertainty, political instability, and currency fluctuations play significant roles in shaping market dynamics. Retailers and manufacturers must remain adaptable, carefully monitoring these factors to align their strategies with evolving consumer behavior.

As we move forward, it will be crucial to watch how these factors continue to influence the market. Will the U.S. maintain its position as the leading market for Swiss watches? How will the significant declines in China and Hong Kong affect global sales? And can Japan’s rising imports sustain their upward trajectory? Only time will tell.

Q: Why did Swiss watch exports to the U.S. drop in May?

A: The drop was due to economic uncertainty, political turmoil, and ongoing pressure on households’ cost of living, which led retailers to take on less stock.

Q: How does the U.S. market for Swiss watches compare to China and Hong Kong?

A: The U.S. remains the largest market for Swiss watches with a 15.7% share of global exports, nearly doubling the combined share of China and Hong Kong.

Q: Why have Swiss watch exports to China and Hong Kong declined so sharply?

A: The significant declines in China and Hong Kong are attributed to broader economic challenges and political issues affecting consumer spending in these markets.

Q: What caused the increase in Swiss watch imports to Japan?

A: The increase is due to the weakness of the Japanese yen, which made prices more attractive to international visitors, boosting imports by 5.8% in May.

Q: What are the broader trends in Swiss watch imports and retail sales in 2024?

A: Across the first five months of 2024, growth in imports has exceeded retail sales growth, indicating robust demand for certain models but higher overall inventory levels.